This post may contain affiliate links. See my disclaimer for more information.

Welcome to the twenty-first net worth report here at NMI!

This report is coming in over three months late. Sorry about that. I actually had it almost all the way done, and then, just…never finished it.

While I wish I had some elaborate excuse as to why, I really don’t. I have been pretty busy with my main job and my various side hustles, and at the end of this month I started a part-time job on one of my days off, so – I guess I’m working six days a week now.

I’ve also been trying to start my own businesses, while continuing my freelance work for my one client.

In short, I’m hella busy and I feel like I never have enough time to do all the nothing I want, so to the backburner the blog goes 🙁

This post is so late and I am eternally tired, so let’s just dig in to the numbers, shall we?

For those new to my net worth reports, I’d like to give you a few minor details.

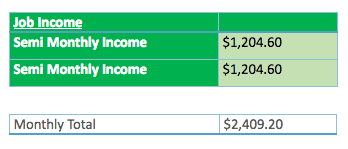

I get paid semi-monthly, which means I get paid on the 15th and the last day of the month.

Sometimes my money isn’t made available to me until two or three days after the month has already changed, so in order to ensure the most accurate net worth reports, I will always include both incomes. As such, my reports will be made available on the third or fourth day of the following month, possibly (probably) a few days after.

In rare circumstances in which I fail to get paid on time, I will either wait until that money is made available to report or I will include it in the following month’s net worth report.

You can find the latest and/or past reports here.

These figures are accurate as of the end of the day, May 10th.

MY INCOME

JOB INCOME

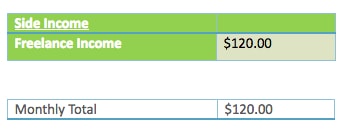

SIDE INCOME

For the twelfth month since doing these reports, I have some additional side income to report!

This month was definitely a little on the slow side, as I didn’t have any additional income from eBay, Etsy, or the consignment store, but I did make some money from some freelance work.

I also started a new side job that you may have seen me yacking about on Twitter – working at my brother’s sub shop!

Sub Shop

My brother has been trying to get me to work at his store for a long time now (as in, quit my job), but it just didn’t make financial sense. I make decent money at my job, have good benefits, and for the most part, like it.

I would also take a significant pay cut if I were to leave, and would no longer be my own boss.

To get my foot in the door (and my brother off my back), I finally told him I would work a bit on one of my days off.

So far, I’ve been working every Thursday, usually from 10 am to 2 pm, sometimes longer, sometimes shorter.

I tend to do a variety of things – pretty much whatever is needed from me at that time. That ranges from doing deliveries and making food to stocking items, cleaning the store, etc.

It’s been cool working in a new environment and industry, learning new things, and working with new people.

I’ve been doing the same job for over 12 years. I can’t tell you how nice it is to just experience something new.

I’m liking the job so far, and despite just a few hiccups, I see myself doing this for the foreseeable future.

As far as the money: despite working one day in April, I didn’t actually get paid for that day, for some reason? 😀 – so here are some photos of the shop’s delicious food!

FREELANCE

I also have some exciting news regarding my freelance job – I’m going to be producing original content!

While that’s not too different from just writing pieces for my own blog (which is getting kinda rare 😉 ), it is awesome that I’m getting paid to do it!

It’s kinda fun being given a writing task and seeing how it develops.

Hopefully this can build up my portfolio, which I can use to snag some additional clients.

I was mostly doing content auditing work before, so it’s nice to be creating totally original content.

On the flip side, I’ll be doing much less work, so I won’t be getting paid as much. This first month, I wrote one article and was paid $120.

Still, I’m just thankful that I can do this as a side job and actually get paid to write!

TOTAL SIDE INCOME

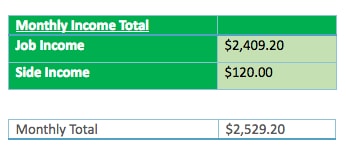

TOTAL INCOME

MY ASSETS

SAVINGS

Last month I reached my savings goal for the year, which was to save $15,000 in a high-yield savings account.

This represents approximately one-years worth of living expenses. It feels nice having that as a safety net, as I never seem to know how the business is going to go. One month we’re super slow and scraping by, the next we’re doin’ fine.

Thus is the nature of high-end consignment, I suppose.

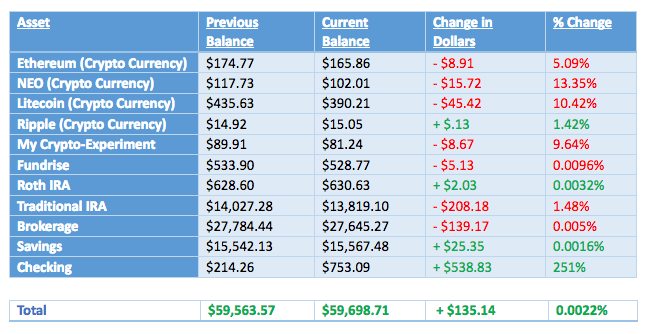

INVESTMENTS

April was a pretty neutral month as far as my investments go. I don’t have much else I want to add 😛

Remember, when it comes to crypto, never part with more money than you’re willing to lose! I’ve learned that the hard way!

Here’s a link to my article on cryptocurrency that every beginner should check out before jumping in.

*I decided to try an experiment in which I purchased 43 different cryptocurrencies (worth about $900.00 total) in the beginning of 2018 with the intent of holding onto them for one full year. You can check out the initial post here. I will be posting updates to that portfolio around the 15th of each month.

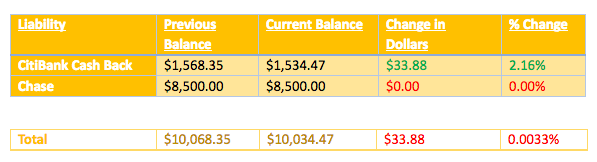

MY LIABILITIES

This month stayed mostly flat, as I was pretty much even between my income and expenses. Unfortunately, as you can see, I still have quite a bit of headway to make in paying down my credit card debt.

I transferred a large chunk of money last month onto another 0% offer on a Chase card, so that gives me a little more breathing room, but my goal is to have this all paid off in the next six months.

Something tells me I’ll start getting things paid off* 😉

*It’s me, I’m the one telling you, because I’m writing this three months from the future because I’m a bad blogger – but I have actually been making a good stride in paying my debts back.

I highly recommend automating all of your bills, especially if they allow you to pay with a credit card. You set it up once and you don’t have to worry about it again.

The only expenses I don’t automate are bills that pull from a checking account – you want to be sure the money is in there before it gets debited.

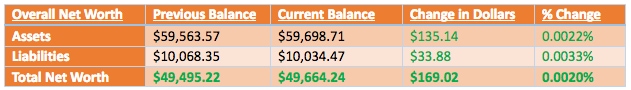

MY NET WORTH

An INCREASE of + $169.02!

Whew, that was a close one. Just squeaked by with a positive month. I’m actually quite surprised that I didn’t go into the negatives.

This is the reason I do net worth reports – to make sense of all the craziness that goes on during the whole month. Between my income and expense fluctuations, the stock market’s performance and my spending, it can be hard to know if you’re going in the right direction.

I did recently notice that many bloggers split their net worth reports and their savings and expense reports into two different posts, while I combine them into one and leave out the expenses 😉

Maybe I’ll do that in the future. For now, I enjoy the current format. It leaves a little mystery. Like, why do my credit cards keep going up? Maybe I stupidly invested in an ostrich farm that was built next to a coyote farm. Maybe I’m a drug-lord specializing in smuggling cute puppies.

Maybe I’m a personal finance blogger that just sucks with money.

Either way:

CONCLUSION

And that wraps up the twenty-first net worth report here at NMI!

Did your net worth increase this month? Suffer a setback you wanna complain about? I’d love to know in the comments!

– NMI

And if you like reading monthly financial updates, you can check out some posts from some other bloggers here:

Net Worth Update #7: August 2019 : From One Geek to Another

[…] you like reading Net Worth Updates, check out these guys:Route 2 FIOur Table 4 TwoNew Millennial InvestorFour Pillar […]