This post may contain affiliate links. See my disclaimer for more information.

Welcome to the twentieth net worth report here at NMI!

This one’s coming in earlier to make up for last month’s late report. And yet, still later than usual. Sorry about that 😀

March was another sweet month for my finances, with a lot of growth and one big milestone being hit. Notably, that I’ve saved a year’s worth of living expenses. For me, that’s $15,000.00!

I’m pretty happy of this as I am constantly hearing about a market correction. And yet, the stock market keeps going up.

Whatever.

I was also pretty happy with March as I got my tax return (both state and federal), got paid for some stuff from the consignment store, sold some stuff on eBay and Etsy, and finished my freelance work for my client!

Overall, this is probably going to be one of my highest grossing months ever.

Let’s dig in to the numbers.

For those new to my net worth reports, I’d like to give you a few minor details.

I get paid semi-monthly, which means I get paid on the 15th and the last day of the month.

Sometimes my money isn’t made available to me until two or three days after the month has already changed, so in order to ensure the most accurate net worth reports, I will always include both incomes. As such, my reports will be made available on the third or fourth day of the following month, possibly a few days after.

In rare circumstances in which I fail to get paid on time, I will either wait until that money is made available to report or I will include it in the following month’s net worth report.

You can find the latest and/or past reports here.

These figures are accurate as of the end of the day, April 10th.

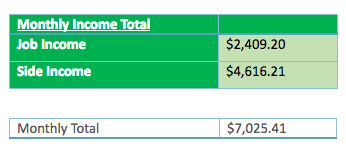

MY INCOME

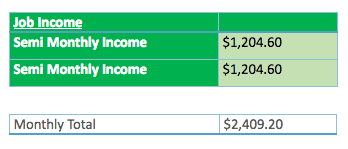

JOB INCOME

Things are still pretty slow at work :/

So much so that I didn’t get paid for the second half of March until April 5th. Thankfully I have a regular stream of side income.

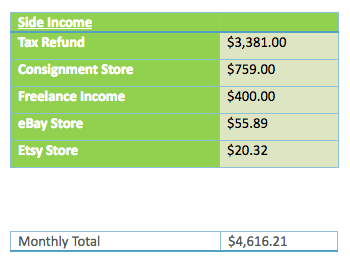

SIDE INCOME

For the eleventh month since doing these reports I have some additional side income to report!

This was my most diverse month ever, with income coming from five different sources other than my normal job.

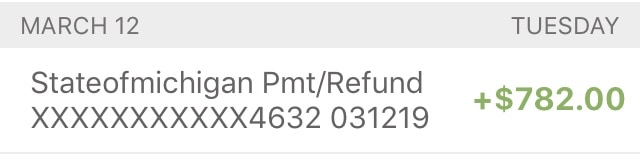

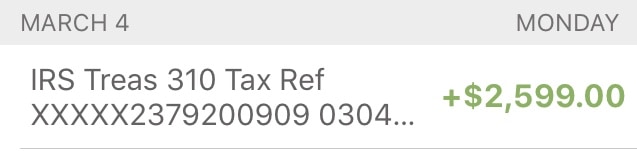

TAX RETURNS

I received a significant tax return this year, which was so awesome. Even awesom-er was that I got it done totally for free using Credit Karma Tax. I usually use Turbo Tax, but I was so sick of paying like $100 to $150 just to file taxes that I started to look around for other options.

It worked 😉

I got to keep 100% of my refund – a first.

Here was my state tax:

And federal tax:

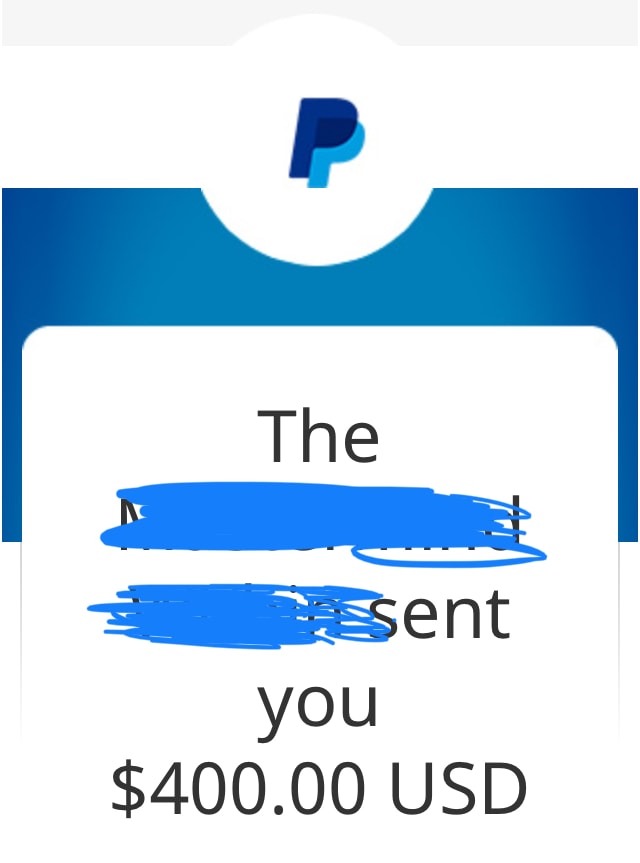

FREELANCE

I finished up the remaining work for my freelance client and got a hefty $400 check for that.

Things are going well. We’re trying to grow his blog and audience while getting rid of unnecessary content and making things more focused.

With the main job finished, I was worried this would be the end of our working relationship, but my client has expressed an interest in having me continue to work for him by writing new content for his site.

It sounds like it would pay near the original job, and it means I’ll continue having income from this source for the foreseeable future, which is awesome.

I also like contributing to the success of a personal finance blog that’s not my own. Like most bloggers, my client is hoping to turn his site into one that brings in thousands of dollars of passive income – and I want to be part of the team that gets him there.

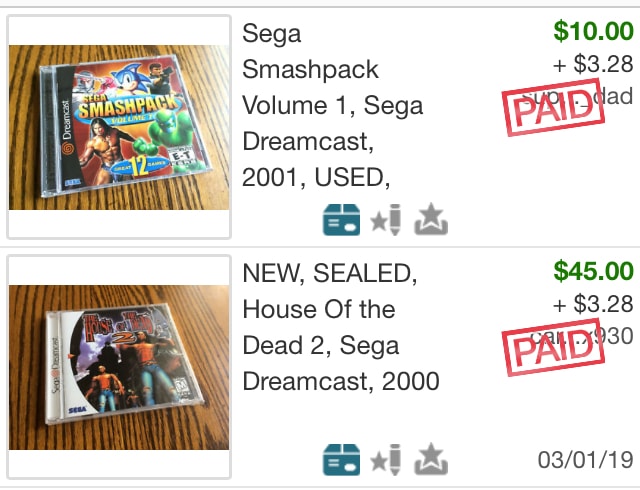

EBAY

Another slower month on eBay, but not totally surprising considering I don’t have much inventory left in my store. I need to go “shopping” for stuff at the local thrift store and auctions.

Still, I’m glad I got a couple things sold. Seems like I’ve been selling at least one thing a month.

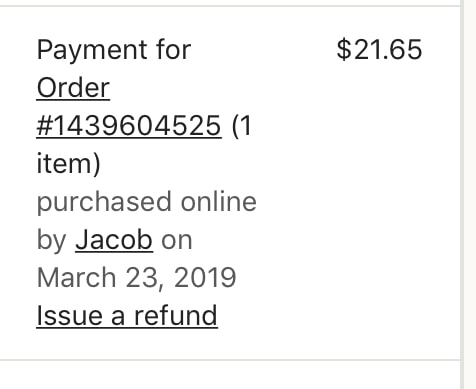

ETSY

I only had one order from Etsy all of March, and it was a smaller one. I got paid $21.65, and less Etsy’s fees, I was paid $20.32.

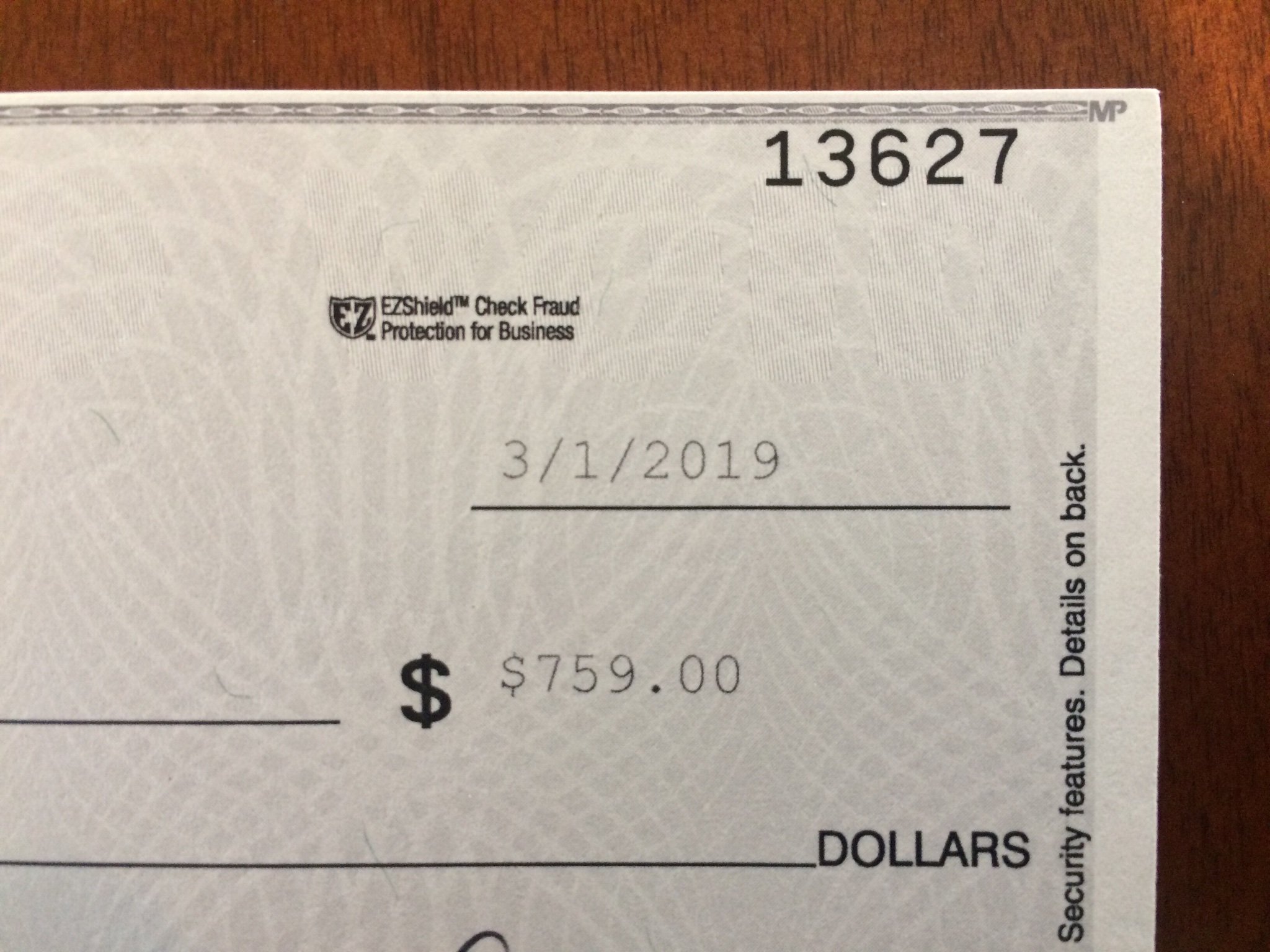

CONSIGNMENT STORE

Things started picking up for my furniture flipping side hustle in late January and February, and I ended up selling over $1,200 worth of stuff, with my gross being $759.00!

These are the items that sold and what they sold for:

And here’s the proof it happened!

TOTAL SIDE INCOME

TOTAL INCOME

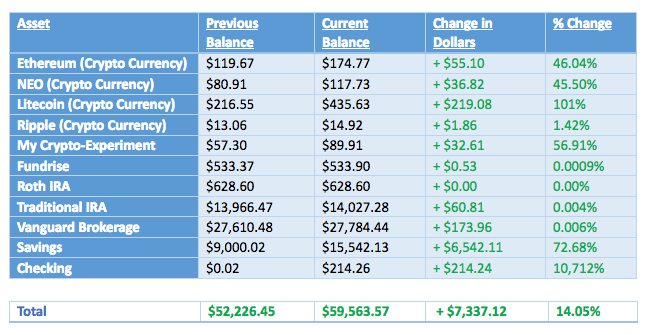

MY ASSETS

SAVINGS

I finally decided to sign up for a high-yield savings account after reading this post from Chief Mom Officer. I decided to go with the Marcus account from Goldman Sachs earning 2.25% interest – way better than the practically negative interest I was getting from my brick-and-mortar bank.

The difference between the two could not have been more clear.

This is a photo of my balance I posted on my Twitter account:

This is why you should always use a high-yield savings account 😂😂

Before and after: pic.twitter.com/MrN6sIjUvc

— Shawn | New Millennial Investor (@NewMillInvestor) April 2, 2019

If you aren’t using one for your spare cash, you’re missing out!

INVESTMENTS

This was another good month for my investments, as the stock market just seems to slowly climb higher.

Crypto started its slow rebound last month, and things seem to be continuing from there.

You know, at one point my overall crypto portfolio was worth over $5,000 – I wonder if we’ll ever see those numbers again?

Still, I’m glad I got out when I did. Also wisely avoided the mistake of buying $10,000 worth of Ripple on a whim when things were crashing. That would have been dumb.

Remember, when it comes to crypto, never part with more money than you’re willing to lose! I’ve learned that the hard way!

Here’s a link to my article on cryptocurrency that every beginner should check out before jumping in.

*I decided to try an experiment in which I purchased 43 different cryptocurrencies (worth about $900.00 total) in the beginning of 2018 with the intent of holding onto them for one full year. You can check out the initial post here. I will be posting updates to that portfolio around the 15th of each month.

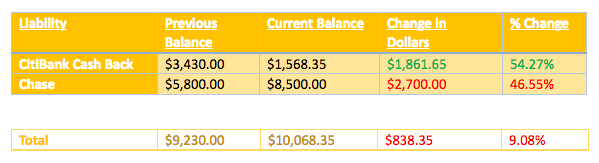

MY LIABILITIES

I transferred about $3,250 from my Citi card to my Chase card, which has a 0% interest promotional balance, to at least save a little money on interest. While that balance seems to be ever increasing, my goal is to pay off the remaining Citibank card and then focus my all on the Chase card.

I’m sorry if this sounds like a broken record. I seem to have a “I’m hoping to pay the debt off next month” problem 😉

I really recommend automating all of your bills, especially if they allow you to pay with a credit card. You set it up once and you don’t have to worry again. The only ones I don’t automate are accounts that need a checking account – you want to be sure the money is in there before it gets debited.

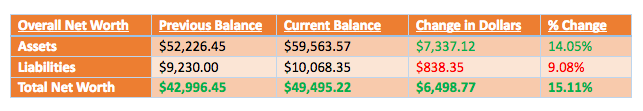

MY NET WORTH

An INCREASE of + $6,498.77!

This is the best month I’ve had since I’ve been tracking my net worth here at New Millennial Investor!

While this huge increase was mostly due to getting my taxes back, I am proud of my continued side hustle earnings. It shows that consistent dedication can yield big results.

I have plans to replicate these numbers in the future.

Namely, I’ve got a couple side hustles I’m working on. I just set up my first LLC, so the wheels are in motion. I’m hoping to reveal more next month 🙂

CONCLUSION

And that wraps up the latest net worth report here at NMI!

March was a whirlwind, and going into spring and summer, I’m optimistic that things will only get better from here. Blue skies. Green trees. And hopefully more income and less debt.

How is your 2019 going so far? I’d love to hear about it!

– NMI

Erik @ The Mastermind Within

Hey Shawn, awesome month!

I have a question… with your fat savings account, why are you holding off on paying down the credit cards in full?

It seems like you could knock these out pretty quick, but maybe I’m missing something like you are saving up for a down payment or investment.

Thanks for sharing all of this, super awesome to see the numbers go up 🙂

Erik

Shawn

Hey Erik!

You’re right, I could pay these down pretty easily with my savings. The reasons I’m not just taking them out is because:

– my job seems less and less secure as time goes on

– I wanted to save a year’s worth of living expenses because of that insecurity

– I really love watching my savings go up 😛

– my cards are at 0% interest

– I’m saving for a crash

This was one of my main goals for 2019. Now that I’ve reached it, my next goal is to throw everything I can at these credit cards. In a way, paying these cards down would probably better set myself up for a crash/recession, but oh well – too late now. 😀

Thanks for stopping by!

Net Worth Update #3- April 2019 : From One Geek to Another

[…] you like reading Net Worth Updates, check out these posts from Our Table 4 Two and New Millennial Investor as well. […]