Welcome to the eleventh net worth report here at NMI!

It’s hard to believe, but June is already over, with the middle of summer coming right on its tail.

Time really does seem to fly by faster as you get older.

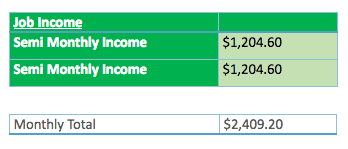

For those new to my net worth reports, I’d like to give you a few minor details. I get paid semi-monthly, which means I get paid on the 15th and the last day of the month.

Sometimes my money isn’t made available to me until two or three days after the month has already changed, so in order to ensure the most accurate net worth reports, I will always include both incomes. As such, my reports will be made available on the third or fourth day of the following month, possibly a few days after.

In rare circumstances in which I fail to get paid on time, I will either wait until that money is made available to report or I will include it in the following month’s net worth report.

You can find the latest and/or past reports here.

These figures are accurate as of the end of the day, July 8th.

MY INCOME

JOB INCOME

Summer continues to go well. I got paid both of my checks on time this month.

SIDE INCOME

Unfortunately, for the first time in four months, I don’t have any side income to report, which kinda sucks.

I do have a lot of irons in the fire though, so it’s really just a matter of time.

I still have a bunch of consigned furniture at the store and I actually sold $450.00 (a $270.00 net for me) worth of my own stuff in June! Checks don’t get paid out until the following month though, so I won’t be reporting the income until I actually cash the check.

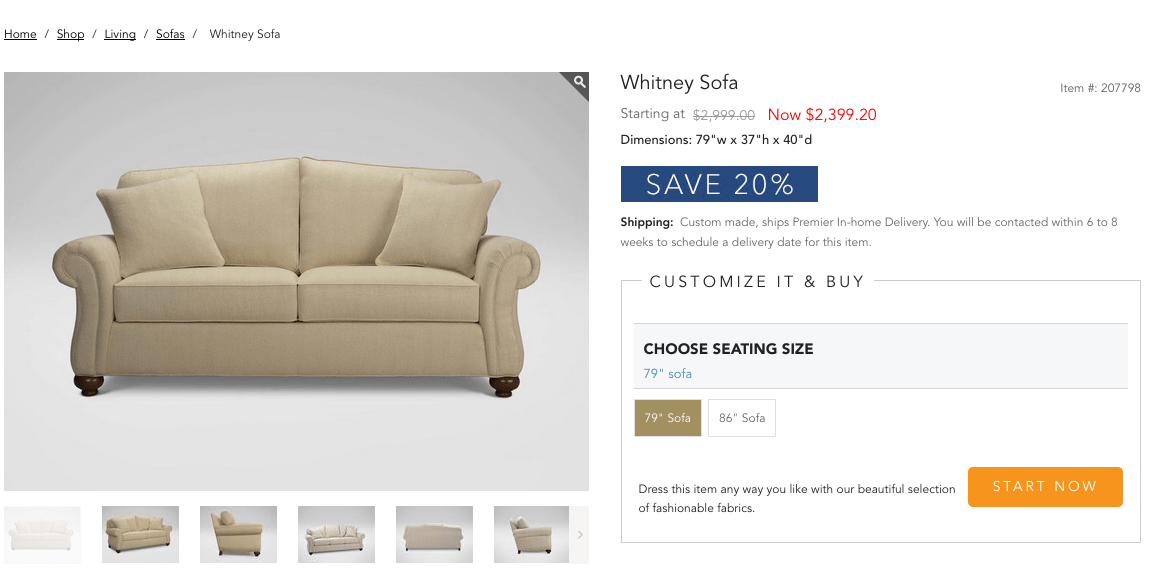

I also got an Ethan Allen sofa and ottoman, and a wooden side table and a leather top side table from an auction for $206.38.

The sofa currently retails on Ethan Allen’s website for $3,000.00! Here’s what it looks like.

We’re going to sell the sofa for $795.00, the ottoman for $150.00, and the leather top side table for $195.00 (the wooden side table had a broken drawer that I didn’t notice, so I won’t be able to sell that for now). That gives me a total of $1,140.00 worth of merchandise. If they all sell at full price, my net will be $684.00. Subtracting the cost of them, that’ll leave me with a profit of $477.62! Not bad, considering all I really had to do was pick them up and bring them to the store.

I’ve also got my eye on some furniture that I’d like to sell at another local consignment store. While we specialize in higher-end pieces, this store focuses more on nice, good condition, mid to low-tier pieces. There’s a market for both, so why not capitalize on it, right?

This allows me to increase my inventory, giving me more types of items to look out for and two sources of additional income!

These auctions always seem to have a steady flow of new furniture, so I’ll constantly be getting new pieces, and I know this other furniture store stays busy, so there’s no reason that I can’t make both endeavors into a source of (kinda) passive income.

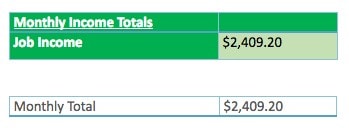

TOTAL INCOME

MY ASSETS

SAVINGS

My savings took a decent hit this month.

I took out $1,171.00 to pay off some debt from the main Citibank card I use. I also took out $1,298.00 to pay off another discretionary bill.

INVESTMENTS

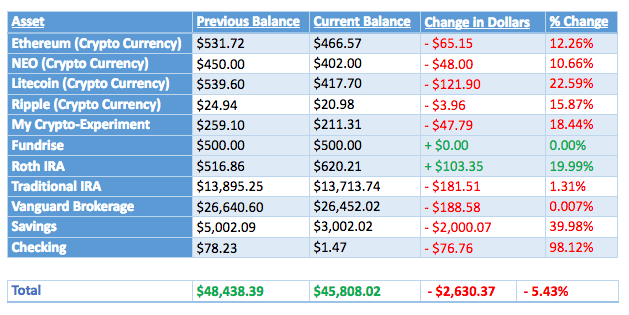

My investments took a hit too.

Just look at all that red.

Pretty much all of my investments are down from last month. Couple that with the paying down of some debt and I’m down for the second time since these reports began! 😭

Remember, when it comes to cryptos, never part with more money than you’re willing to lose! I’ve learned that the hard way!

Here’s a link to my article on cryptocurrency that every beginner should check out before jumping in.

*I decided to try an experiment in which I purchased 43 different cryptocurrencies (worth about $900.00 total) in the beginning of 2018 with the intent of holding onto them for one full year. You can check out the initial post here. I will be posting updates to that portfolio around the 15th of each month.

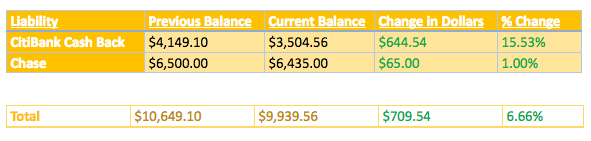

MY LIABILITIES

I’ve done it! I actually decreased my debt by a bit for the first month in awhile!

While it’s not much, it’s a good start!

My main goal is to get that Citibank card down to zero, and then only having to pay monthly payments to the Chase card. Then besides my regular bills and my car payment, I really won’t have much monthly debt and I can start saving and investing even more. If I really stick to it, I think I could have the Citibank card down to zero in a couple of months.

I really recommend automating all of your bills, especially if they allow you to pay with a credit card. You set it up once and you don’t have to worry again. The only ones I don’t automate are accounts that need a checking account – you want to be sure the money is in there before it gets debited.

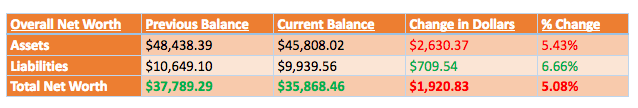

MY NET WORTH

A decrease of – $1,920.83!

Yikes.

This was not a good month for my net worth. I guess that’s kinda what happens when you pay down debt/bills and take money from your savings to do it.

Ah well.

I hate seeing the red, but it’s probably going to be like that for a little while.

At least until next month’s report, I hope.

CONCLUSION

While I’m a little disappointed that my net worth decreased, it’s nice to see that I’m making some headway on my debt. I (hopefully) get paid next week and will put a large chunk to that, and when I get paid at the end of the month I’m going to try to use some of that for the debt too.

I’m betting this time next month my overall portfolio is going to look pretty different.

So, how is your 2018 going?

– NMI

Leave a Reply