This post may contain affiliate links. See my disclaimer for more information.

Welcome to the tenth net worth report here at NMI!

This year is flying by. It’s officially summer!

It’s time for hot days, hot dogs, and biking!

It’s also time to do the monthly check-up on my finances, so here ya go! But first:

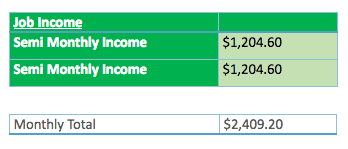

For those new to my net worth reports, I’d like to give you a few minor details. I get paid semi-monthly, which means I get paid on the 15th and the last day of the month.

Sometimes my money isn’t made available to me until two or three days after the month has already changed, so in order to ensure the most accurate net worth reports, I will always include both incomes. As such, my reports will be made available on the third or fourth day of the following month, possibly a few days after.

In rare circumstances in which I fail to get paid on time, I will either wait until that money is made available to report or I will include it in the following month’s net worth report.

You can find the latest and/or past reports here.

These figures are accurate as of the end of the day, June 12th.

MY INCOME

JOB INCOME

This summer has actually been pretty busy. That makes me optimistic, as this time last year was not a good month. I also got my second check early – which is always a nice bonus.

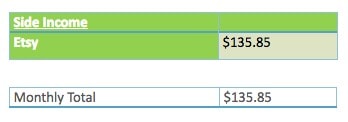

SIDE INCOME

For the fourth month in a row, I have some additional side income to report!

My Etsy store continues to grow, grossing $135.85 this month! This is almost twice as high as last month!

I can’t say I’m making a ton of money off of it, but it’s nice to have some steady side income.

I also bought a handful of things to put in the furniture store and sell online, like some planters, some cool stepping stones, four high-end bar stools that I got for $100 bucks total and some accessories. I currently have almost $2,500.00 worth of items listed. If they all sell at their current price, I’ll earn 60% of that selling price, meaning I should net $1,500.00! Not a bad chunk of change, especially considering I only have about $450.00 into everything, meaning I’ll profit over $1,000.00!

Unfortunately, none of this stuff has sold, so I’m just waiting on this income to be generated.

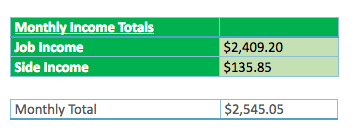

TOTAL INCOME

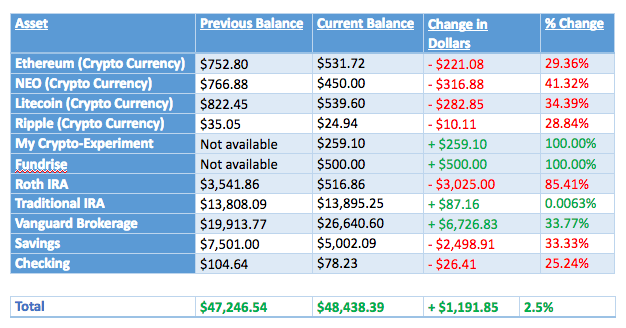

MY ASSETS

SAVINGS

I took out another $2,500.00 to add to my brokerage account so I could purchase some more VTSAX.

INVESTMENTS

Not only did I add some more VTSAX to my brokerage account, I also withdrew the majority of my Roth IRA to put into my brokerage account so I could purchase even more VTSAX. I’m not going to be contributing to my Roth anymore (and I haven’t for over a year, since using a traditional IRA will actually help me get to FI faster) so I figured I’d take my contribution and merge it with my brokerage account, maximizing my earnings. I’m trying to consolidate my funds.

I also decided I’ll include my crypto-experiment fund in my net worth calculation from now on because I finally paid back the balance last month (since I put the purchase on a credit card a few months back). I figure it’s money that exists and is mine, so I may as well claim it as such.

I also tried investing in a new real estate index fund with a company called “Fundrise”. I’m working on a post about it now. It’s an interesting concept, in which your funds are invested in various properties around the US that Fundrise searches for, acquires, and uses for business. I just put $500.00 into it for the ninety-day trial they offer, but I don’t know that I’m going to stick with it. $500 is such a small investment amount that it seems like it doesn’t make much sense to do it.

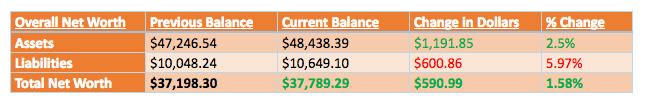

Overall, my portfolio is doing pretty well. While cryptos are way down, that’s not surprising as they’re constantly fluctuating. The rest of my portfolio is continuing to slowly move in the positive direction, and I’m very close to reaching another personal milestone, including possessing $50,000.00 in assets and a $40,000.00 net worth.

Remember, when it comes to cryptos, never part with more money than you’re willing to lose! I’ve learned that the hard way!

Here’s a link to my article on cryptocurrency that every beginner should check out before jumping in.

*I decided to try an experiment in which I purchased 43 different cryptocurrencies (worth about $900.00 total) in the beginning of 2018 with the intent of holding onto them for one full year. You can check out the initial post here. I will be posting updates to that portfolio around the 15th of each month.

MY LIABILITIES

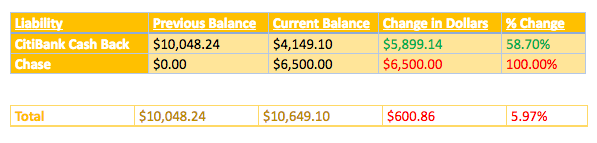

This month, my liabilities changed quite a bit. Because I use my Citi card for every purchase, whether it’s for bills, supplies for my Etsy store or purchasing furniture and accessories for my consignment store side-hustle, the balance seems to just keep growing. I hate it. It’s suffocating.

In an effort to combat this, not only did I put myself on a cash-diet to help (here’s post one & two of that experiment), I also did a balance transfer of $6,250.00 (plus a $250.00 fee) from my Citi card to my Chase credit card. I received a well-timed Chase promotion that was offering no interest until the middle of next year for any balance transfer. This will save me hundreds of dollars over the next year, and it also gives me a little bit of breathing room. With just over $4,000.00 on my Citi card, I can whittle that down to zero, and then start tackling the Chase balance without worrying about paying any interest.

It’s probably gonna take awhile, but I’ll get there.

I really recommend automating all of your bills, especially if they allow you to pay with a credit card. You set it up once and you don’t have to worry again. The only ones I don’t automate are accounts that need a checking account – you want to be sure the money is in there before it gets debited.

MY NET WORTH

An increase of + $590.99!

Yes! Another positive month! We’re almost up to the one year mark here at NMI and I’ve only had one down month so far. Glad to continue the trend!

I know I say this every month, but I’m GOING TO PAY DOWN THIS DEBT. After the success of the cash diet, I know I can put myself on a budget and stick with it. When my next paycheck comes in a few days, I’m going to take $200.00 out to last me the rest of the month, and use the rest to pay down debt (I may save a little).

After all:

CONCLUSION

2018 is quickly rolling by, and I’m happy to see that I continue to increase my net worth and bring in additional income every month.

I’m still very far off from accomplishing my goal of having $75,000 in assets saved by the end of this year, but there is still time to make good on it.

And I actually am trying!

With summer practically here, how is your 2018 going? Accomplish any goals? Maybe set a new one? I’d love to know!

– NMI

Leave a Reply