If you’ve been following along with my portfolio, you’d know that I have a little bit of money invested in a few different cryptocurrencies.

While my portfolio is actually doing pretty well, I recently came across some information that helped me decide I’d like to try another, hopefully even more profitable, strategy.

This information came from Caleb, a personal finance blogger from Australia. On his website, buyholdlong.com, he shows how a small crytpo-account with an initial investment of just $1,000.00 could lead to massive gains – simply by diversifying the portfolio between the top 100 coins and tokens.

In this hypothetical portfolio, investing a mere $1,000.00 and splitting it evenly between the top 10, top 20, top 50, or top 75 coins at the beginning of the year can result in returns as high as 12,000% over an entire year! That’s crazy!

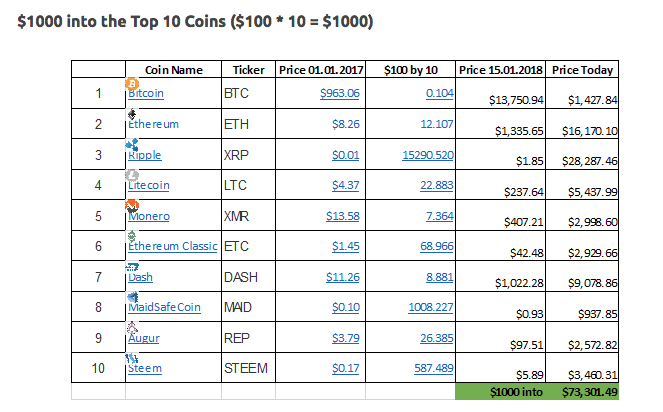

Here’s one of the examples from buyholdlong.com‘s post.

By investing in a number of different cryptocurrencies instead of just one, the portfolio almost performs as an index fund, with the extreme volatility of some currencies being hedged against the more stable, well-known ones.

The problem with this method is that in the world of crypto, nothing is for certain: a day in the top 100 (even top ten) is not unusual for even the lamest of coins. Especially when we’re talking about an entire year, there will be many changes: new coins will debut, only to crash quickly; some favorites will rise to the top, while others will disappear completely. The market is highly speculative, to say the least.

Still, there are some good, solid projects out there that in a few years time will hopefully have real-world practical applications. Those are generally the ones to bet on, and they’re usually located within the top 10.

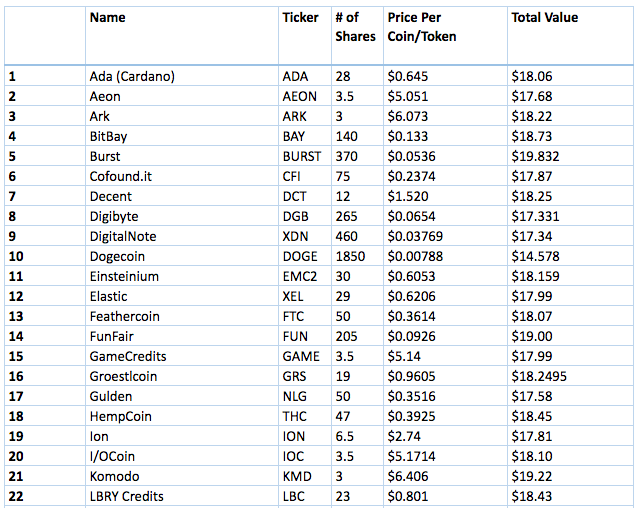

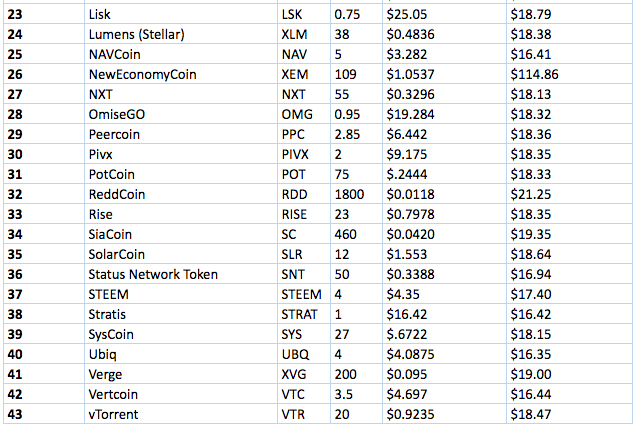

Because I already had a few coins from the top ten and I wanted to spread out the risk, I decided I would split my picks between forty-three different currencies.

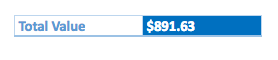

My plan is to hold them for one full year to see exactly what type of returns I can get. If I’m lucky, this could speed up my retirement plan by a couple of years! If I’m wrong, then I could lose $1,000.00 trying something new – a small price to pay for such big potential. My $1,000.00 will be evenly split up between forty-three different currencies, so each one will be worth about $20.00*, give or take a dollar.

* You may be saying, $20 x 43 is only $860.00, not $1,000.00. That’s true. Unfortunately, using a site like Coinbase.com to purchase bitcoin incurs a fee – leaving you with a bit less than your purchase amount.

In order to trade bitcoin for another currency, you have to send it over to an exchange, which also incurs a fee. Then, after the order for the desired currency is placed and filled, that transaction incurs a fee. It all quickly adds up, especially when you’re making multiple purchases. It left me with a little less than $900.00 to trade, less transaction costs and purchase fees. To keep the purchase amount of each pick even and to include a larger amount of choices, I picked forty-three different currencies.

If you use my referral link to buy $100.00 worth of crypto on Coinbase.com, we’ll both get a free extra $10.00!

THE METHODOLOGY

I used coinmarketcap.com to look up the top 100 currencies on January 15th and made my purchases on the 16th. Because I was already invested in four currencies currently located within the top ten (NEO, Ethereum, Ripple and Litecoin), I decided I would choose between the remaining ninety-six. My choices ran the gamut from relative newcomers with a good reputation (ADA) to well known alt coins (DogeCoin).

Keeping most of my pick’s share prices under $1 per coin was extremely important as I only had roughly $20.00 to spend on each currency and I wanted to concentrate my picks on low priced coins that had the chance to increase in value many times. I did include a few that were priced between $1 and $5, and even one over $25 for diversity’s sake. After my fortieth purchase or so I got kind of sick of it so I threw the remaining $100 into XEM. Not super methodical, but whatever ha ha.

MY PICKS

Here, I’ll list all the currencies I purchased for my experiment, including the name, ticker, number of shares, the price per coin/token and their total value.

I’ll be giving monthly updates on its progress, but I won’t be including it in my net worth reports, as I’d like to keep my original crypto-portfolio separate from this one.

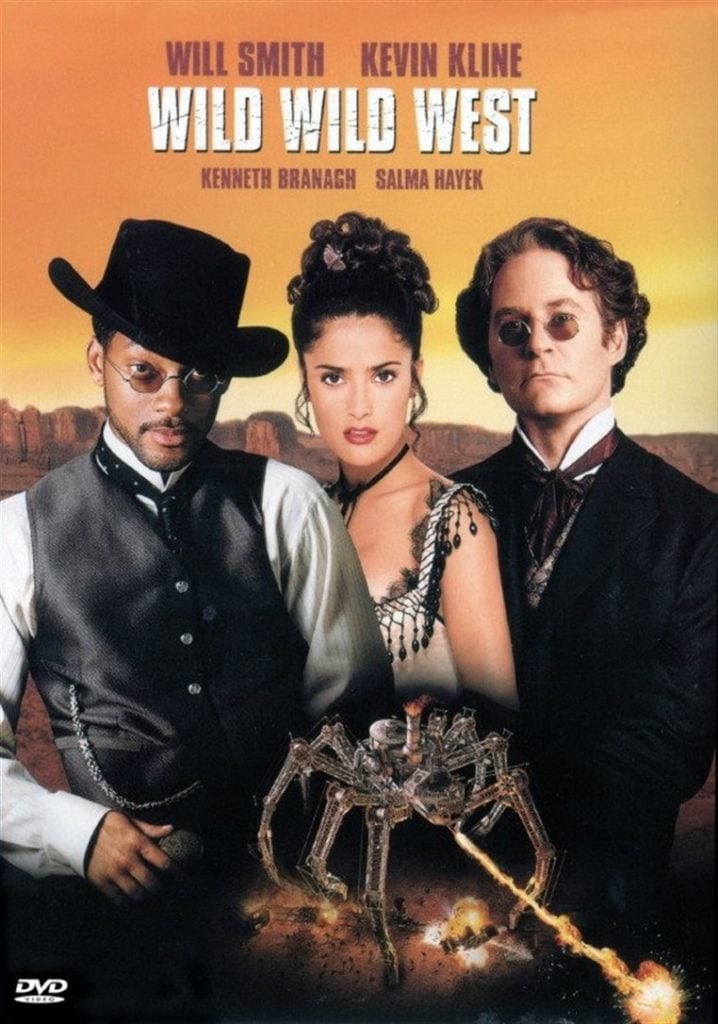

My plan is to not obsess or worry over this portfolio – I’m simply going to let it do what it’s going to do. My hope is that a handful of them will be breakouts with not too many that crater – but really, who knows? The crypto landscape is like the Wild West!

I still haven’t decided what to do once (or if) it reaches the double digits. Should I cash out? Hold until exactly one year just to complete the experiment? I feel like I may make those decisions as the year progresses.

What are your thoughts? Do you think this could work? Or do you expect it to crash and burn? Let me know in the comments!

– NMI

This post may contain affiliate links.

PK

With all of the hype on bit currency and blockchain, it will be interesting to see the 1-year results. I would expect a few to crash or disappear and a few to do reasonably well, say in the 10-20%. Maybe one will give stellar returns. Now you have me hooked and I’ll need to watch for updates.

-best regards

Shawn @ NMI

Thanks PK, I’m anxious to see how it turns out as well! Thanks for stopping by!

Olivia @ birds of a fire

This is actually pretty interesting. I’m half considering this for fun. I’m 25, so losing a few grand is really not the end of the world. The basis of this trade hinges on “Crypto will rally in 2018”, it just allows you to diversify. I think I would create an index of the better performing coins though. Better performing = fastest transaction times and lowest fees. I think I’d also invest only in proof of state coins. To my understanding, proof of work fails when the price of a coin becomes too high. Ie, bitcoin and it’s 30 fees to verify.

Shawn @ NMI

I think that’s a good idea, Olivia – kind of like how Caleb’s post shows that holding just the top ten performers did quite well over last year. Picking the ones that are already good at what they do at a low cost is definitely a good way to go. I think many of the most popular but less expensive coins are still a really solid investment right now.

Thanks for commenting!

Raman K

Didn’t you also have some ether in your portfolio? On another note I am doing something similar and might share my portfolio in a subsequent blog post. This looks awesome and I think even if a couple of those coins take off, you’d get magnificent gains. There is a lot of upside and very little downside. I have most of my money tucked away in to Ether and Bitcoin though.

Shawn @ NMI

Hey Raman! I do have one Ether in my portfolio, along with a little Litecoin, NEO, and Ripple. I’m definitely excited to see how it changes throughout this upcoming year! I’d love to see your plan too – you’re right, there really is very little downside when you’re talking about investing just $500 to $1000. Why not just go for it? The magnificent gains offset the small loss you might incur. I still think Ether, Litecoin, and Bitcoin are pretty good investments, as long as you’re OK with volatility.

calebsnodgrass

Similar to what we saw last year, a few will outperform or crash and a few will soar, you just have to pick the very few that will soar and you will be very happy. Good luck, I’m glad I could share with others!

Shawn @ NMI

Ha ha exactly right! I think I got a few good picks! Thanks again for the inspiration!