My boss has always been terrible when it comes to dealing with money.

Over the last ten plus years that we’ve worked together, I’ve seen him do a lot of stupid things with his.

Dropping hundreds of dollars on single dinners. Randomly buying a $5,000.00 Cartier watch while on vacation. Getting a new car because the current lease was up and a $1,000.00 repair wouldn’t have been covered (what?).

He’s also up to his ears in credit card debt, spends more than what his income brings in and he isn’t aware of all his debts.

And believe it or not, these aren’t even his worst offenses.

Now he’s nearing retirement age, and for all the fun he had spending money throughout his life, he doesn’t have a whole lot to show for it.

Pushing sixty and not having a firm hold on your finances is not a good spot to be in.

And he can thank it all to these three major money mistakes.

If you’re making any of these mistakes, it’s possible you could find yourself in the same position.

Here are three ways my boss is terrible with money – and how to avoid making the same mistakes yourself.

1. HE BUYS LIABILITIES, NOT ASSETS

My boss loves the finer things in life – which is great.

I love nice things too. I don’t think there’s anything wrong with the occasional splurge, and for some items, it makes sense to pay a little more.

But for him, whether it’s jewelry, clothes, furniture, cars, food, fun or housing, pretty much every aspect of his budget has an extravagant slant to it.

That kind of spending fills up your life with stuff, stuff and more stuff.

And that lifestyle is really expensive to maintain.

First you spend money on an item. Then you spend more money on keeping it in good condition and a place to house it. Then you spend more money to fix it when something inevitably goes wrong, and then you spend one last time if you decide you can’t live without the item and buy it again. Then the whole cycle repeats.

Unfortunately, none of those items (bar a house) build wealth – and even a house isn’t a good investment if you can’t afford it or it’s in a crappy area.

The BMW? Not his so all the payments return a big fat $0 (plus what you lose to opportunity cost, and yes, I understand the irony because I lease a car too).

That fancy $5,000.00 Cartier watch? Now only worth $2,000.00. Worst investment ever.

And those extravagant nights out at ritzy bars and restaurants? Empties your wallet and fattens your gut.

Accumulating expensive stuff doesn’t build wealth, it destroys it.

BUY ASSETS THAT BUILD WEALTH

I inherently try to live a more frugal and minimalist lifestyle than the average person.

I hate clutter.

And while I have spent a lot of money on “dumb” stuff, like this replica blue Power Ranger helmet that cost way too much,

most of my assets are invested in stocks, bonds, savings or in inventory for my furniture flipping side hustle.

These are all ways of using or “spending” money that will lead to greater wealth, not less.

A. STOCKS

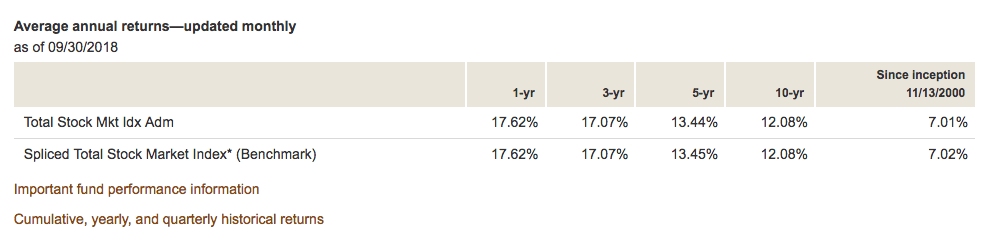

Purchasing the Vanguard Total Stock Market Index Fund (VTSAX) will net you an average return of 7%, which is nothing to sneeze at. Even with the recent market correction, the returns it has given in this decade long (and hopefully continuing) bull market puts the since-inception average to shame.

If you can’t afford the $10,000.00 investment, you can use the ETF version (VTI) that’s priced per share, or the Investor Shares mutual fund version (VTSMX) that only requires a $3,000.00 initial investment.

B. BONDS

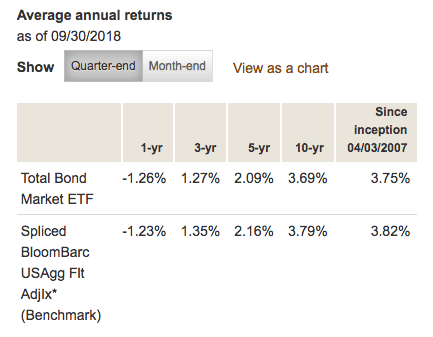

Purchasing the Vanguard Total Bond Market ETF (BND) will net you an average 3.75% return, and offers less volatility than stocks, but with less reward. Bonds are used as a hedge against equities.

I use the ETF over the Admiral Shares version (VBTLX) because I have quite a bit less than the $10,000.00 requirement, as I’m investing in equities aggressively, and my asset allocation is about 90% stocks, 10% bonds. That being said, I should probably look into upgrading to the Investor Shares like…now (VBMFX).

C. OTHER INVESTMENTS

Starting a business or side hustle allows your money to increase many times over.

At the consignment store I manage, I’ve been able to turn a $428.85 investment of furniture and other accessories into $1,261.80! That’s almost a 300% return, and for most of these items, all I had to do was go pick the items up, bring them to the store, and price them well (usually about half of purchase price, if the piece is just a couple years old or newer). New stuff and pieces that were still current I priced close to their current retail price.

I further increase my wealth by investing that money back into stocks, bonds, furniture flipping inventory, or saving – I try not to just blow it on stuff.

Invest in assets that build wealth, like stocks, bonds, a side business or education.

2. HE NEVER SAVES

You’d think someone who made in the upper five figures a year with few business expenses would be able to save even a small percentage of his income.

But alas. He was not blessed with a gift for managing his finances.

So when something goes wrong – and in life, there’s always something about to go wrong – he’s not financially prepared.

A tax bill that randomly came in from the government. An unexpected medical bill. His car taillight needing replaced.

For someone who saves, while annoying, these events would probably be considered relatively benign.

But for someone who never saves, any one of these small expenses can cause huge problems.

If you don’t have any money saved but you need it for an emergency, you’ll have to finance it in some way – whether that’s with a credit card, a loan, or borrowing from friends or family.

And none of these options put you in a good place.

When you borrow money from someplace or someone, you’re beholden to them. Plus, if you don’t save, how do you, like, afford stuff?

PLEASE SAVE!

Something, anything!

Whatever you can spare, whatever you can cut out, whatever you do not need, even if it’s just a tiny fraction of your income, do it!

You will be so glad you did.

Whenever I get paid I always transfer a little money into my savings account – always.

Even if it’s just $25, do yourself a favor and start now when you’re young (and if you’re not young, while you still have time).

The usual recommendation is to save 10% of every check, but you should try for as much as you can.

Saving money, whether that’s through cutting costs or putting money aside, is the first tool towards reaching financial independence.

3. HE HAS never INVESTED IN THE STOCK MARKET

The stock market gets a bad rap. Because of that, far fewer people are familiar with it than should be – like my boss.

I don’t think he knows anything about the market, and he seems to be OK with that.

What he shouldn’t be OK with is all that money he’s missed out on from not investing these last 30 plus years.

When I was reading “The Simple Path to Wealth” by JL Collins, I left a copy at work, and one day he noticed it. “The Simple Path to Wealth, huh?” Curiously, instead of picking it up and glancing through it, or asking me questions about it, he just passed it by and went on his way.

He apparently has no knowledge or desire to learn about the market (or even money in general).

And with that, he has made a great mistake.

The two biggest wealth creators? The stock market and time.

By not investing in the stock market, you’re missing out on one of the greatest wealth builders known to man.

SERIOUSLY, YOU NEED TO INVEST IN THE STOCK MARKET

Yes, really. You need to.

SAVING IN A BANK ACCOUNT

Saving money is great and all, but when it’s just sitting in a bank account earning a measly 1.25% interest, that’s simply not going to cut it.

Here’s an example:

Let’s say we’re starting with $0 saved and can contribute $100 a month to a savings account. Earning 1.25% interest over a period of ten years, and this is what the results look like:

WHAT? $782.02? That’s a return of just 6.51% over a period of ten years! Total! God, that’s awful. You are not going to get wealthy that way.

INVESTING

On the other hand, investing in index funds is one of the easiest and most consistent ways to build wealth. It certainly blows just using a savings account out of the water.

Here’s an example:

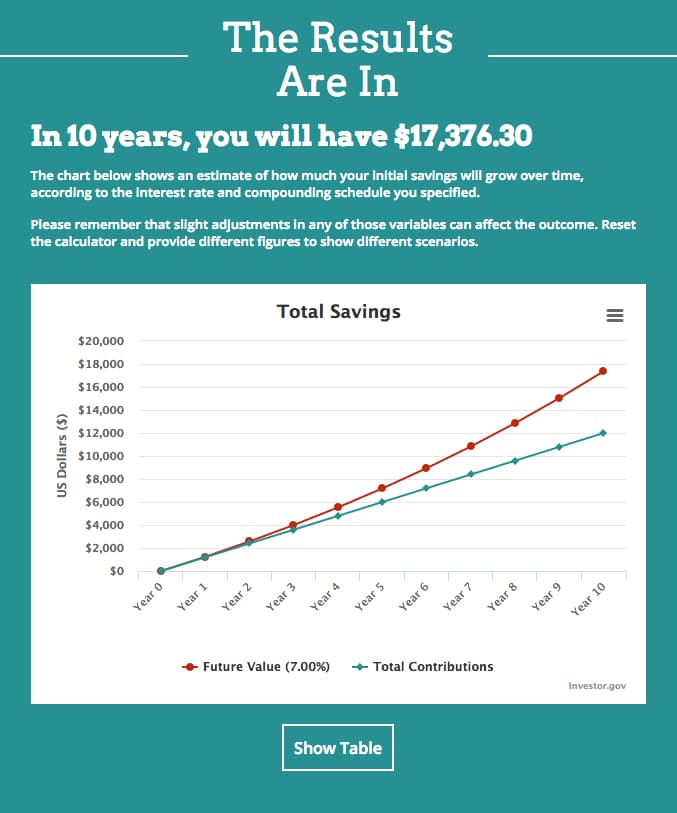

Let’s say we’re starting with $0 saved and can contribute $100 a month to an investment account. Earning 7% interest over a period of ten years, and this is what the results look like:

A return of $5,376.30! Also known as 44.80%! That is an incredible difference in return compared to the crummy savings account.

INVESTING with time

To drive home the point, let’s take a look at an example of investing from an earlier age.

My boss is currently 58. I started investing when I was 31. Let’s look at the results if he had been investing for that period of time.

Let’s say we’re starting with $0 saved and can contribute $100 a month to an investment account. Earning 7% interest over a period of twenty-seven years, and this is what the results look like:

A return of $63,911.47, and a worth of almost $100,000.00! That’s pretty darn good considering that’s only contributing $1,200.00 a year. And the total return is worth almost twice the initial contribution itself!

I’d say that’s pretty good!

It’s clear that investing in the market is the place to put your money.

If you’re in your 20’s or 30’s, your focus should be on investing to increase your wealth as quickly as possible.

Investing in the stock market is the second tool to use to reach financial independence.

CONCLUSION

I’d say based on what’s listed out here, my boss has a lot of work to do.

And if you’re making any of these big money mistakes, you do too.

There’s no time like the present to take charge of your finances, and depending on your age, you may not have a lot of time to do it. Not blowing your money on worthless stuff, saving your money, and investing in something (hopefully a broad market index fund with some bonds as a hedge) will set your future self up quite handsomely.

So don’t be like my boss, OK?

freddy smidlap

after selling ebay stuff for the past year i really learned a lot about what increases or retains value. almost half our sales were from 3 items that nobody wanted. watches rarely hold value. save, invest, repeat. i agree.

Shawn

Hey Freddy! I’m glad you’ve had success selling on Ebay – funny that your best sales were from stuff “no one wants”.

I try to be open about what I pick up, but I also try to stick to stuff that’s well known and loved by all, just to make it easy on myself. I have some impulse stuff that I got from earlier this year that I still haven’t been able to sell.

And yes – save, invest, repeat and be rich! Thanks for commenting.