This post may contain affiliate links. See my disclaimer for more information.

I can hear the collective FI-ers clutching their pearls, saying “WHAT?!”

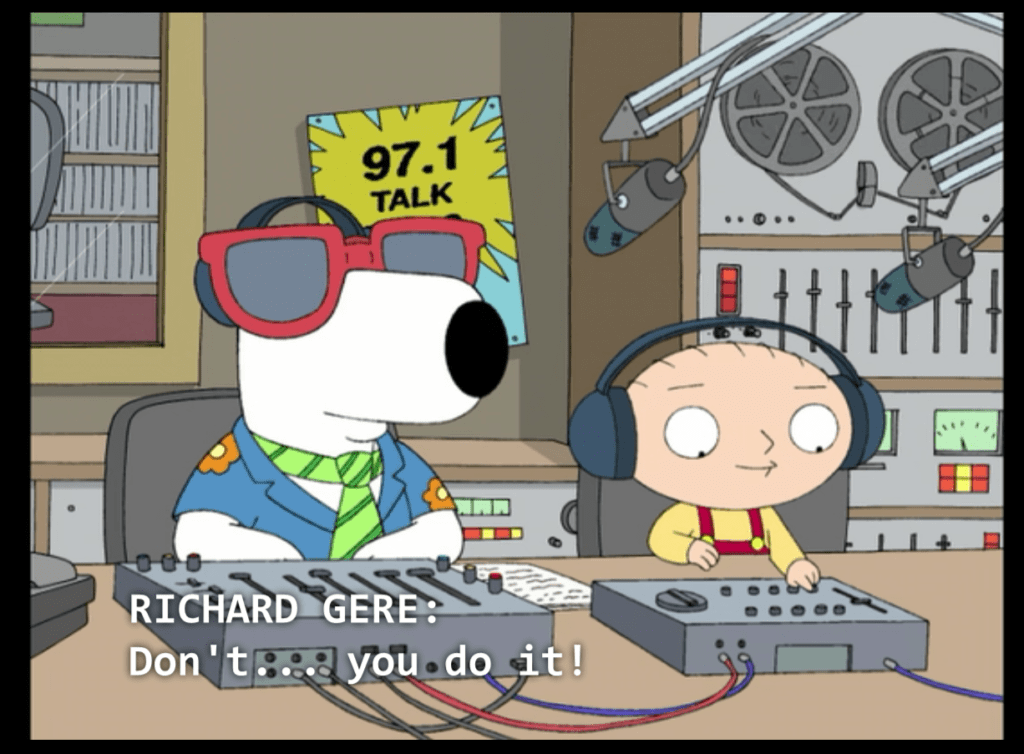

“If you’re thinking about changing the station:”

Yes, I’m deleting Personal Capital from my phone – and it has nothing to do with the recent bloodbath in the markets.

Don’t get me wrong, I love Personal Capital. It changed the way I look at my money, and I love being able to see my entire portfolio’s value at a glance. It also gives great insights into what you can do to improve your portfolio, and how to reach your retirement and investment goals.

Whether it’s the investment checkup, the fee analyzer, or tracking of every single dollar that goes into (and out of) your account, Personal Capital gives people a lot to love.

In fact, I love it too much!

SO WHAT’S THE PROBLEM?

I’ve become addicted to looking at Personal Capital!

Whether I’m at home relaxing on the couch, typing up an email to a client at work, hanging out at a friend’s house or going for a jog on the treadmill, I cannot keep myself from opening the app to stare at those numbers.

I engage with it multiple times throughout the day, especially if it’s a particularly good (or bad) day. I love seeing my portfolio’s value jump up, and I’ll continue to refresh the app multiple times, hourly, to see how it changes.

I’ve actually caught myself staring at my phone when the market isn’t even open!

All of this in itself isn’t that big of a deal – there are worse things in life one could be addicted to. And when striving to reach financial independence, it’s important to make goals and track your progress; that’s really the only way one can gauge their successes and failures.

In my case, however, this has clearly gotten out of hand. I feel that it also comes with some more serious implications.

IT WASTES SO. MUCH. TIME.

Time spent staring at that little screen pulls me away from doing any number of more fulfilling and important things. Precious time that could be better spent working on my blog, or developing a side hustle, or, God forbid, doing something fun which doesn’t even have to do with money or reaching financial independence.

As much as I love getting an insight into ways I can improve my portfolio, or increase my tax savings in retirement, I have better things to do than just obsessively checking my portfolio.

Which leads me to my second point:

IT MAKES ME PASSIVE RATHER THAN ACTIVE

It places a focus on the end result of financial independence, rather than focusing on what it takes to actually get there.

Instead of using the numbers from PC as a motivation to try something new or get a side job, I feel like it’s actually made me complacent. When I see those numbers going up, I feel like my goals are already getting accomplished – that I don’t have to put in the extra time or effort to go even further. That I’m further ahead than I was yesterday, so why change anything?

This is obviously a problem, because I want to accelerate my journey to financial independence , not remain stagnant. My goal is to get there as fast as I can, not as fast as I can while doing the least amount of work (though that is generally my MO in life).

I love Personal Capital, and I’m going to continue using it. But for now, for my own personal growth, I’m deleting it from my phone for awhile.

As our President of the United States used to say:

Raman K

You know what, I don’t blame you. I think personal capital is great. However, I don’t use it on my phone. First, it may have something to do with what you have written here. Second, I am not crazy about its UI on the phone. I only login to PC once every day after I get back from work to see what the markets did. And I am not sure what you’re buying to see gains coz my portfolio is taking a hit these days!

Shawn @ NMI

Hey Raman! This past week my accounts have taken a beating too – I’m probably down about 10%.

We had such a good 2017 this little correction was quite a surprise.

Good for you that you only look at them once a day. Probably not as stressful as constantly checking them like me ha ha.

Thanks for commenting!